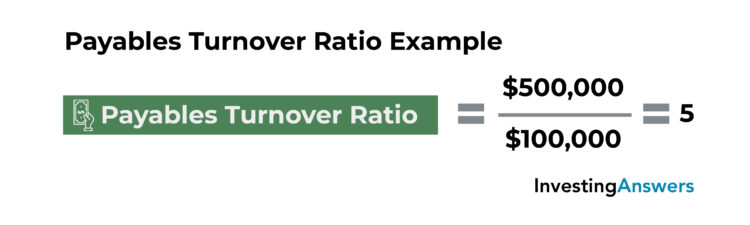

Accounts receivable turnover ratio shows how effective a company is at collecting money owed by clients. It proves whether a company can efficiently manage the lines of credit it extends to customers and how quickly it collects its debt. If a company has a low ratio, it may be struggling to collect money or be giving credit to the wrong clients. This means that Company A paid its suppliers roughly five times in the fiscal year. To know whether this is a high or low ratio, compare it to other companies within the same industry.

How Can You Analyze Your Accounts Payable Turnover Ratio?

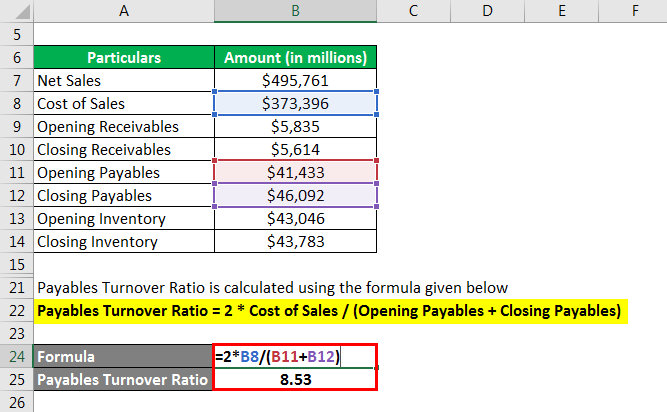

The AP turnover ratio provides valuable insights into a company’s payment management efficiency and financial health. It provides insights into liquidity, working capital management, and the company’s ability to meet its financial obligations. An increasing A/P turnover ratio indicates that a company is paying off suppliers at a faster rate than in previous periods, which also means that the number of days payables are outstanding is less. If the company’s accounts payable balance in the prior year was $225,000 and then $275,000 at the end of Year 1, we can calculate the average accounts payable balance as $250,000. The accounts receivable turnover ratio is an accounting measure used to quantify a company’s effectiveness in collecting its receivables, or the money owed to it by its customers.

Importance of Your Accounts Payable Turnover Ratio

A higher accounts payable turnover ratio is almost always better than a low ratio. It’s used to show how quickly a company pays its suppliers during a given accounting period. In financial modeling, the accounts payable turnover ratio (or turnover days) is an important assumption for creating the balance sheet forecast. As you can see in the example below, the accounts payable balance is driven by the assumption that cost of goods sold (COGS) takes approximately 30 days to be paid (on average). Therefore, COGS in each period is multiplied by 30 and divided by the number of days in the period to get the AP balance.

Credit Card Reconciliation – Types, Challenges, Strategies

In short, accounts payable (AP) represent the money you owe to vendors or suppliers. Accounts payable appears on your business’s balance sheet as a current liability. So, it’s time to upgrade if you don’t use accounting software like QuickBooks Online.

Common Challenges in Maintaining a Good Accounts Payable Turnover Ratio

- Again, a high ratio is preferable as it demonstrates a company’s ability to pay on time.

- Instead, investors who note the AP turnover ratio may wish to do additional research to determine the reason for it.

- If your AP turnover is too low or too high, you need a ratio analysis to identify what’s causing your AP turnover ratio to fall outside typical SaaS benchmarks.

- Here are a quick, easy answers to some of the most commonly asked questions about accounts payable turnover ratios.

- Startups are particularly reliant on AP aging reports for startup cash flow forecasting and runway planning.

- Reports help you maintain healthy AP processes, ensure accurate financial statements, build better supplier relationships, and improve financial decision-making.

Then, divide the total supplier purchases for the period by the average accounts payable for the period. An accounts payable disbursement report is a list of all the entries you’ve created when you process payments to your suppliers. In other words, it shows all payments leaving your AP account over a specified period of time. When you reconcile accounts payable, you’re verifying that the amount owed to suppliers and vendors matches what’s listed in your financial statements. Ideally, you’d reconcile accounts payable at least monthly to catch discrepancies early and correct your outstanding balances. While the accounts payable turnover ratio provides good information for business owners, it does have limitations.

A bigger concern, though, would be if your accounts payable turnover ratio continued to decrease with time. The accounts payable turnover formula is calculated by dividing the total purchases by the average accounts payable for the year. Given the A/P turnover ratio of 4.0x, we will now calculate the days payable outstanding (DPO) – or “accounts payable turnover in days” – from that starting point. The days payable outstanding (DPO) metric is closely related to the accounts payable turnover ratio.

For example, let’s say you pay for a SaaS subscription monthly on the 5th of the month. Even before you receive a formal invoice, your AP department might accrue that expense since it’s a recurring expense they know is coming. You can use this accrual report alongside your recurring invoice report (see below) to help ensure all recurring expenses are accounted for.

Beginning accounts payable and ending accounts payable are added together, and then the sum is divided by two in order to arrive at the denominator for the accounts payable turnover ratio. As with all ratios, the accounts payable turnover is specific to different industries. For instance, if a company’s accounts receivable turnover is far above that of its peers, there could be a reasonable explanation. However, it is rarely a positive sign, i.e. it typically implies the company is inefficient in its ability to collect cash payments from customers. The Accounts Payable Turnover is a working capital ratio used to measure how often a company repays creditors such as suppliers on average to fulfill its outstanding payment obligations.

One of the most common ways to accommodate for this lack of information is to add the cost of goods sold in a given year to a company’s year-end inventory figure. This can be especially problematic if the organization you’re evaluating experiences irregular or unpredictable business operations throughout the year. They also promote strong communications spend and receive money transactions in xero between business finance and operations, which need to work together to make both strategic and tactical decisions. If you start with an AP balance of $0 and end with an AP balance of $2,000, your average AP balance is $1,000. And, if you start with an AP balance of $2,000 and end with an AP balance of $0, your average is still $1,000.

Not only is a higher ratio result a sign of financial strength, it also shows creditors that the business has an established track record of paying its bills in a timely manner. The easiest way to keep that straight is to use your accounting software to run your balance sheet for just the starting day and then just the ending day of the accounting period you want to consider. AP automation software from BILL simplifies the accounting process so your business can avoid late charges, stay on top of payments and improve overall financial visibility. If your AP turnover for the same quarter is above 5.2, that would look better to creditors. However, it might also mean that your company pays its bills more quickly than you need to, tying up cash you could use in other ways.

Remember, the decision to increase or decrease the AP turnover ratio should be based on the specific circumstances and financial goals of the company. It’s essential to strike a balance between maintaining good relationships with suppliers and managing cash flow effectively. A high Accounts Payable Turnover Ratio is an indication of a company’s financial health and creditworthiness. Lenders, investors, and creditors use the ratio as a key indicator when evaluating a company’s creditworthiness. A high ratio indicates that a company is managing its creditors effectively and is more likely to have access to credit and financing on favorable terms.